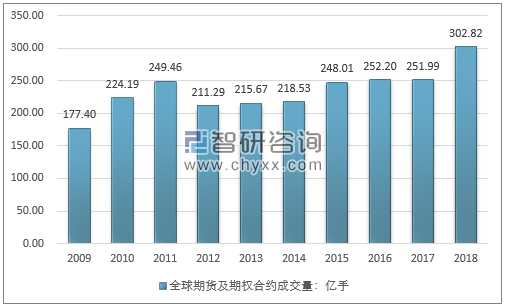

据FIA对全球衍生品交易所成交量的最新统计,2018年,全球期货及期权合约成交量302.8亿手,较上年增长20.2%,再创历史新高。

2008-2018年全球期货及期权合约成交量:亿手

资料来源:FIA、智研咨询整理

分交易所看,2018年,芝商所、印度国家证券交易所依然处在全球衍生品交易所成交量排名的前两位,成交量分别为48.4亿和37.9亿手,同比分别增长18.5%和53.7%。巴西交易所成交量大增42.3%至25.7亿手,超越洲际交易所排在第3位。洲际交易所成交量24.7亿手,同比增长16.41%,居于第4位。

2017-2018年全球期货交易所排名

排名 | 交易所 | 2018年 | 2017年 | 同比变化 |

1 | CME Group | 4,844,856,880 | 4,089,345,897 | 18.48% |

- | Chicago Mercantile Exchange | 2,259,630,942 | 1,891,568,238 | 19.46% |

- | Chicago Board of Trade | 1,778,590,729 | 1,408,034,345 | 26.32% |

- | New York Mercantile Exchange | 652,470,369 | 653,295,150 | -0.13% |

- | Commodity Exchange (COMEX) | 153,713,320 | 136,012,283 | 13.01% |

- | Eris Exchange 1 | 451,520 | 435,881 | 3.59% |

2 | National Stock Exchange of India | 3,790,090,142 | 2,465,333,505 | 53.74% |

3 | B3 | 2,574,073,178 | 1,809,358,955 | 42.26% |

4 | Intercontinental Exchange | 2,474,223,217 | 2,125,404,062 | 16.41% |

- | ICE Futures Europe | 1,276,090,376 | 1,166,947,836 | 9.35% |

- | NYSE Arca 2 | 460,113,644 | 302,568,725 | 52.07% |

- | NYSE Amex 2 | 389,866,979 | 293,548,459 | 32.81% |

- | ICE Futures U.S. | 342,613,160 | 354,504,852 | -3.35% |

- | ICE Futures Canada 3 | 2,973,036 | 5,545,879 | -46.39% |

- | ICE Futures Singapore | 2,566,022 | 2,288,311 | 12.14% |

5 | CBOE Holdings | 2,050,884,142 | 1,810,195,197 | 13.30% |

- | Chicago Board Options Exchange 2 | 1,283,269,272 | 1,132,457,708 | 13.32% |

- | BATS Exchange 2 | 422,706,669 | 409,693,613 | 3.18% |

- | C2 Exchange 2 | 150,923,570 | 141,207,528 | 6.88% |

- | EDGX Options Exchange 2 | 118,429,304 | 52,844,958 | 124.11% |

- | CBOE Futures Exchange | 75,555,327 | 73,991,390 | 2.11% |

6 | Eurex | 1,951,763,081 | 1,675,898,310 | 16.46% |

7 | Nasdaq | 1,894,713,045 | 1,676,626,292 | 13.01% |

- | Nasdaq PHLX 2 | 724,170,578 | 641,637,538 | 12.86% |

- | Nasdaq Options Market 2 | 428,650,957 | 340,852,645 | 25.76% |

- | International Securities Exchange 2 | 402,504,406 | 334,888,824 | 20.19% |

- | International Securities Exchange Gemini 2 | 205,043,832 | 191,019,945 | 7.34% |

- | Nasdaq Exchanges Nordic Markets | 87,272,887 | 86,420,359 | 0.99% |

- | Nasdaq NFX | 22,012,655 | 49,108,109 | -55.18% |

- | Nasdaq Boston 2 | 17,424,846 | 23,967,125 | -27.30% |

- | International Securities Exchange Mercury 2 | 5,982,457 | 5,731,749 | 4.37% |

- | Nasdaq Commodities | 1,650,427 | 2,823,651 | -41.55% |

- | Nasdaq NLX | 0 | 176,347 | -100.0% |

8 | Moscow Exchange | 1,500,375,257 | 1,584,632,965 | -5.32% |

9 | Korea Exchange 4 | 1,408,257,756 | 1,015,335,674 | 38.70% |

10 | Shanghai Futures Exchange | 1,201,898,093 | 1,364,243,528 | -11.90% |

- | Shanghai Futures Exchange | 1,175,388,670 | 1,364,243,528 | -13.84% |

- | Shanghai International Energy Exchange 5 | 26,509,423 | n/a | n/a |

11 | BSE | 1,032,693,325 | 609,215,973 | 69.51% |

- | BSE | 1,022,757,747 | 608,434,204 | 68.10% |

- | India International Exchange | 9,935,578 | 781,769 | 1170.91% |

12 | Dalian Commodity Exchange | 981,927,369 | 1,101,280,152 | -10.84% |

13 | Zhengzhou Commodity Exchange | 817,969,982 | 586,070,148 | 39.57% |

14 | Hong Kong Exchanges and Clearing | 480,966,627 | 372,186,941 | 29.23% |

- | Hong Kong Exchanges and Clearing | 296,183,076 | 214,845,348 | 37.86% |

- | London Metal Exchange | 184,783,551 | 157,341,593 | 17.44% |

15 | Miami International Holdings 2 | 421,320,501 | 232,223,967 | 81.43% |

- | MIAX Pearl 2 6 | 220,609,083 | 41,070,094 | 437.15% |

- | MIAX Options 2 | 200,711,418 | 191,153,873 | 5.00% |

16 | Japan Exchange | 388,302,535 | 322,408,620 | 20.44% |

17 | Taiwan Futures Exchange | 308,083,576 | 265,705,669 | 15.95% |

18 | ASX | 248,003,922 | 248,449,405 | -0.18% |

- | ASX 24 | 160,313,011 | 147,871,580 | 8.41% |

- | ASX | 87,690,911 | 100,577,825 | -12.81% |

19 | Borsa Istanbul | 236,393,421 | 146,122,348 | 61.78% |

20 | Multi Commodity Exchange of India | 230,339,630 | 198,614,562 | 15.97% |

21 | TMX Group | 218,987,586 | 183,171,887 | 19.55% |

- | Montreal Exchange | 112,193,082 | 96,267,503 | 16.54% |

- | Boston Options Exchange 2 | 106,794,504 | 86,904,384 | 22.89% |

22 | Singapore Exchange | 217,387,520 | 178,374,785 | 21.87% |

23 | Rosario Futures Exchange | 192,340,218 | 150,138,251 | 28.11% |

24 | JSE Securities Exchange | 190,696,069 | 382,944,302 | -50.20% |

25 | Euronext | 149,254,141 | 140,276,927 | 6.40% |

26 | Thailand Futures Exchange | 104,422,200 | 78,990,574 | 32.20% |

27 | Tel-Aviv Stock Exchange | 48,107,098 | 46,641,131 | 3.14% |

28 | London Stock Exchange Group | 46,105,494 | 42,437,707 | 8.64% |

- | Borsa Italiana (IDEM) | 36,236,792 | 34,151,018 | 6.11% |

- | LSE Derivatives Market | 9,868,702 | 8,286,689 | 19.09% |

29 | MEFF | 43,502,213 | 44,576,977 | -2.41% |

30 | Tokyo Financial Exchange | 38,833,350 | 38,478,945 | 0.92% |

31 | China Financial Futures Exchange | 27,210,053 | 24,595,938 | 10.63% |

32 | Tokyo Commodity Exchange | 23,597,767 | 24,157,345 | -2.32% |

33 | Dubai Gold & Commodities Exchange | 22,260,136 | 17,439,658 | 27.64% |

34 | National Commodity & Derivatives Exchange | 15,537,378 | 14,130,802 | 9.95% |

35 | Athens Derivatives Exchange | 13,946,112 | 19,447,211 | -28.29% |

36 | Malaysia Derivatives Exchange | 13,726,567 | 14,015,364 | -2.06% |

37 | North American Derivatives Exchange | 12,323,287 | 10,416,392 | 18.31% |

38 | Metropolitan Stock Exchange of India | 10,283,909 | 19,807,967 | -48.08% |

39 | Oslo Stock Exchange | 9,432,118 | 10,795,102 | -12.63% |

40 | Asia Pacific Exchange 7 | 8,523,228 | n/a | n/a |

41 | BMV Group | 8,331,508 | 11,031,286 | -24.47% |

42 | Warsaw Stock Exchange | 8,163,654 | 7,623,156 | 7.09% |

43 | OneChicago | 7,066,292 | 14,929,997 | -52.67% |

44 | Budapest Stock Exchange | 6,703,976 | 7,021,245 | -4.52% |

45 | Pakistan Mercantile Exchange | 2,490,226 | 3,156,470 | -21.11% |

46 | Minneapolis Grain Exchange | 2,335,284 | 2,799,365 | -16.58% |

47 | Dubai Mercantile Exchange | 1,237,175 | 1,575,427 | -21.47% |

48 | Bolsa de Valores de Colombia | 1,064,802 | 1,116,028 | -4.59% |

49 | Mercado a Termino de Buenos Aires | 713,360 | 282,630 | 152.40% |

50 | New Zealand Futures Exchange | 345,651 | 311,675 | 10.90% |

51 | Osaka Dojima Commodity Exchange | 230,247 | 339,521 | -32.18% |

52 | Indonesia Commodity & Derivatives Exchange | 171,672 | 234,030 | -26.65% |

53 | LedgerX 8 | 31,324 | 4,513 | 594.08% |

- | The Order Machine | 0 | 8,973,120 | n/a |

- | OCC | n/a | n/a | n/a |

资料来源:FIA、智研咨询整理

2008-2018年全球期货及期权分类别成交量(亿手)

年份 | 股指 | 个指 | 利率 | 外汇 | 能源 | 非贵金属 | 农产品 | 其他 | 贵金属 | 总计 |

2008 | 64.88 | 55.12 | 32.02 | 5.96 | 5.82 | 1.99 | 8.95 | 0.45 | 1.57 | 176.76 |

2009 | 63.82 | 55.89 | 24.64 | 9.91 | 6.58 | 4.63 | 9.28 | 1.14 | 1.51 | 177.40 |

2010 | 74.16 | 62.95 | 31.96 | 25.26 | 7.24 | 6.44 | 13.06 | 1.38 | 1.75 | 224.19 |

2011 | 84.63 | 70.63 | 34.56 | 31.47 | 8.14 | 4.35 | 9.97 | 2.30 | 3.42 | 249.46 |

2012 | 60.49 | 64.70 | 28.93 | 24.35 | 9.02 | 5.54 | 12.54 | 2.53 | 3.19 | 211.29 |

2013 | 68.30 | 49.47 | 33.44 | 24.97 | 13.15 | 6.46 | 12.11 | 3.46 | 4.34 | 215.71 |

2014 | 73.39 | 49.44 | 33.00 | 21.23 | 11.61 | 8.73 | 13.88 | 3.54 | 3.71 | 218.53 |

2015 | 83.40 | 49.45 | 32.63 | 27.85 | 14.11 | 12.81 | 16.40 | 8.20 | 3.17 | 248.01 |

2016 | 71.18 | 45.58 | 35.19 | 30.73 | 22.14 | 18.77 | 19.32 | 6.16 | 3.12 | 252.20 |

2017 | 75.16 | 47.54 | 39.68 | 29.84 | 21.71 | 17.40 | 13.06 | 4.80 | 2.79 | 251.99 |

2018 | 99.83 | 57.88 | 45.54 | 39.29 | 22.38 | 15.23 | 14.88 | 4.89 | 2.91 | 302.82 |

资料来源:FIA、智研咨询整理

2008-2017年全球期货分类别成交量(亿手)

年份 | 利率 | 股指 | 外汇 | 能源 | 非贵金属 | 个指 | 农业 | 其他 | 贵金属 | 总计 |

2008 | 25.87 | 23.65 | 5.38 | 5.03 | 1.91 | 11.06 | 8.36 | 0.44 | 1.50 | 83.20 |

2009 | 19.40 | 21.67 | 9.50 | 5.92 | 4.57 | 9.47 | 8.82 | 1.14 | 1.39 | 81.89 |

2010 | 25.50 | 23.27 | 24.70 | 6.51 | 6.36 | 11.16 | 12.46 | 1.37 | 1.65 | 112.98 |

2011 | 28.01 | 26.39 | 28.50 | 7.35 | 4.27 | 11.87 | 9.24 | 2.30 | 3.29 | 121.22 |

2012 | 23.49 | 22.91 | 21.61 | 8.04 | 5.48 | 11.20 | 11.79 | 2.53 | 3.07 | 110.11 |

2013 | 27.87 | 24.07 | 21.67 | 11.79 | 6.40 | 10.50 | 11.45 | 3.46 | 4.20 | 121.40 |

2014 | 27.40 | 24.67 | 18.76 | 10.32 | 8.64 | 11.34 | 13.13 | 3.54 | 3.60 | 121.41 |

2015 | 26.96 | 28.38 | 23.14 | 12.69 | 12.72 | 14.04 | 15.59 | 8.19 | 3.07 | 144.78 |

2016 | 28.87 | 26.71 | 24.18 | 20.57 | 18.67 | 12.26 | 18.49 | 6.16 | 3.00 | 158.92 |

2017 | 31.84 | 25.04 | 21.63 | 20.05 | 17.30 | 12.84 | 12.26 | 4.80 | 2.67 | 148.43 |

2018 | 36.80 | 34.31 | 27.63 | 20.76 | 15.37 | 15.13 | 13.87 | 4.89 | 2.77 | 171.51 |

资料来源:FIA、智研咨询整理

2008-2017年全球期权分类别成交量(亿手)

- | 利率 | 股指 | 外汇 | 能源 | 非贵金属 | 个指 | 农业 | 其他 | 贵金属 | 总计 |

2009 | 52.83 | 35.74 | 0.41 | 5.24 | 0.65 | 0.45 | 0.12 | 0.05 | 52.83 | 35.74 |

2010 | 63.38 | 39.30 | 0.56 | 6.46 | 0.73 | 0.59 | 0.10 | 0.08 | 63.38 | 39.30 |

2011 | 75.89 | 41.10 | 2.97 | 6.55 | 0.79 | 0.72 | 0.13 | 0.08 | 75.89 | 41.10 |

2012 | 51.72 | 39.35 | 2.73 | 5.44 | 0.98 | 0.75 | 0.12 | 0.07 | 51.72 | 39.35 |

2013 | 44.23 | 38.96 | 3.31 | 5.57 | 1.37 | 0.66 | 0.13 | 0.07 | 44.23 | 38.96 |

2014 | 48.73 | 38.10 | 2.46 | 5.60 | 1.29 | 0.75 | 0.11 | 0.09 | 48.73 | 38.10 |

2015 | 55.02 | 35.41 | 4.71 | 5.67 | 1.41 | 0.81 | 0.09 | 0.09 | 55.02 | 35.41 |

2016 | 44.47 | 33.32 | 6.55 | 6.32 | 1.57 | 0.83 | 0.12 | 0.10 | 44.47 | 33.32 |

2017 | 50.12 | 34.70 | 8.21 | 7.84 | 1.66 | 0.80 | 0.12 | 0.11 | 50.12 | 34.70 |

2018 | 65.52 | 42.51 | 11.66 | 8.74 | 1.62 | 1.01 | 0.14 | 0.11 | 65.52 | 42.51 |

资料来源:FIA、智研咨询整理

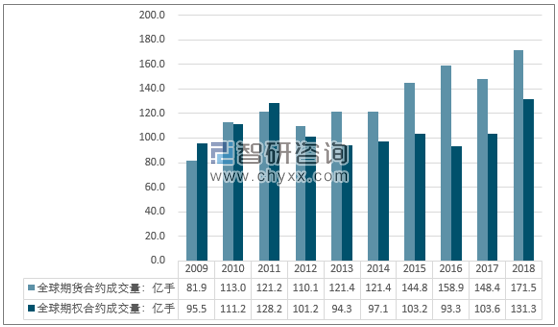

2018年期货合约成交量171.5亿手,同比增长15.6%;期权合约成交量131.3亿手,同比增长26.8%。值得一提的是,2018年全球期货及期权成交量增速为2010年以来的最高水平。

2009-2018年全球期货期权合约分类别成交量走势图

资料来源:FIA、智研咨询整理

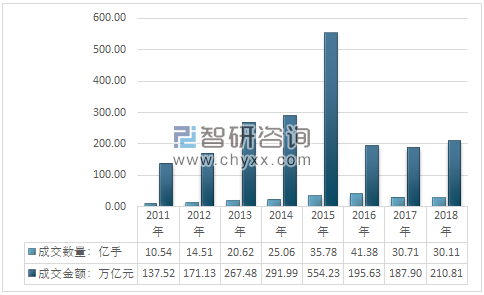

2018年,我国期货市场成交整体呈回暖趋势。全国期货市场累计成交量30.11亿手,同比下降1.97%,累计成交额210.81万亿元,同比增长12.19%。

2011-2018年我国期货成交概况

资料来源:证监会、智研咨询整理

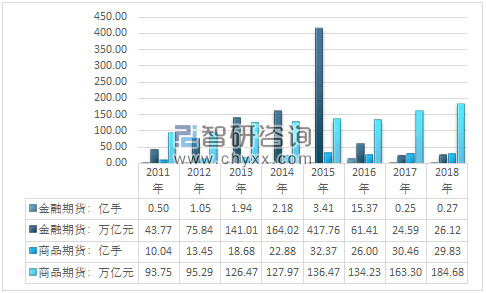

智研咨询发布的《2019-2025年中国期货行业市场深度调研及投资前景分析报告》内容显示,2018年我国商品期货交易数量为29.83亿手,年度交易金额为184.68万亿元;2018年我国金融期货交易数量为0.27亿手,年度交易金额为26.12万亿元。

2011-2018年我国商品及金融期货交易情况

资料来源:证监会、智研咨询整理

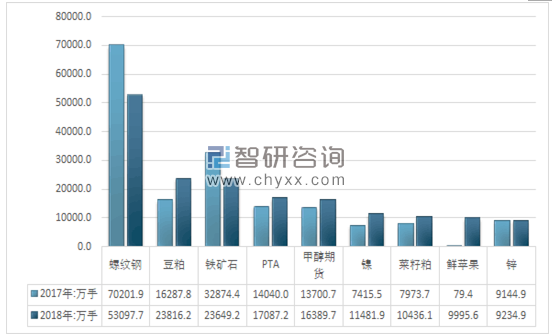

2018年螺纹钢期货年度交易数量为5.31亿手,豆粕期货交易数量为2.38亿手、铁矿石期货交易数量为2.36亿手。

2017-2018年部分期货品种成交数量排名

资料来源:证监会、智研咨询整理

2017-2018年我国期货细分品种交易数量统计表:手

品种 | 2017年成交总量 | 2018年成交总量 |

铜 | 54100135 | 51247050 |

铝 | 65423439 | 46618361 |

锌 | 91449266 | 92348782 |

铅 | 12509166 | 10203832 |

黄金 | 19478090 | 16123891 |

天胶 | 89341052 | 61845475 |

燃料油 | 1432 | 39268835 |

螺纹钢 | 702019499 | 530976610 |

线材 | 98 | 157334 |

白银 | 53111169 | 42250568 |

沥青 | 97440530 | 69802079 |

热轧卷板 | 103131555 | 86816386 |

镍 | 74154526 | 114818738 |

锡 | 2083571 | 2741587 |

漂白硫酸盐针叶木浆 | - | 8975314 |

强麦 | 377494 | 107031 |

棉花 | 26068232 | 58533251 |

白糖 | 61073198 | 64004805 |

PTA | 140399689 | 170871552 |

菜籽油 | 25994757 | 35083678 |

早籼稻 | 1037 | 38199 |

甲醇期货(MA) | 137007280 | 163897244 |

普麦 | 82 | 301 |

玻璃 | 41091381 | 25143634 |

油菜籽 | 1908 | 1354 |

菜籽粕 | 79736545 | 104361264 |

动力煤 | 30708183 | 48874599 |

粳稻(谷) | 261 | 12608 |

晚籼稻 | 202 | 537759 |

硅铁 | 16278210 | 21563209 |

锰硅 | 24921207 | 18856010 |

棉纱 | 124156 | 1533644 |

鲜苹果 | 793933 | 99956445 |

豆一 | 26324058 | 22111727 |

豆二 | 42551 | 24476720 |

豆粕 | 162877864 | 238162413 |

玉米 | 127323949 | 66812732 |

豆油 | 57158378 | 54135551 |

线型低密度聚乙烯 | 61420753 | 36735543 |

棕榈油 | 68046475 | 44344644 |

聚氯乙烯 | 39000407 | 36362787 |

焦炭 | 40121040 | 69071834 |

焦煤 | 42194764 | 46465289 |

铁矿石 | 328743737 | 236491632 |

鸡蛋 | 37262376 | 19918457 |

细木工板(胶合板) | 1286 | 689 |

中密度纤维板(纤维板) | 1056 | 29630 |

聚丙烯 | 56691866 | 49349161 |

玉米淀粉 | 50433910 | 22613108 |

乙二醇 | - | 2323861 |

中质含硫原油 | - | 26509423 |

沪深300指数 | 4101114 | 7486825 |

5年期国债期货 | 2821334 | 1842894 |

10年期国债期货 | 11948981 | 8988739 |

上证50股指期货 | 2443580 | 4517259 |

中证500股指期货 | 3280929 | 4340243 |

2年期国债期货 | - | 34093 |

资料来源:证监会、智研咨询整理

2018年螺纹钢期货年度交易金额为20.17万亿元,焦炭期货交易金额为14.97万亿元,铜期货交易金额为12.98万亿元。

2017-2018年部分期货品种成交金额排名

资料来源:证监会、智研咨询整理

智研咨询 - 精品报告

智研咨询 - 精品报告

2025-2031年中国期货行业市场全景调研及战略咨询研究报告

《2025-2031年中国期货行业市场全景调研及战略咨询研究报告》共十四章 ,包含2025-2031年中国期货行业投资分析与风险规避,2025-2031年中国期货行业盈利模式与投资战略规划分析,研究结论及建议等内容。

公众号

公众号

小程序

小程序

微信咨询

微信咨询